IMF Delays $238 Million Loan for Kenya Kenya may need to find alternative sources to finance its current budget due to a delay by IMF [International Monetary Fund] in issuing it a 28 billion shilling loan ($238 million). Kenya included loan funds in the current fiscal year’s budget. Delay may see the nation seeking alternative budget financing. The funding is part of a $2.34 billion extended credit facility and extended fund facility that was agreed to by the IMF more than a year ago for budget support. The loan needs board approval…

Read MoreCategory: FINANCE

Safaricom and Visa launch M-Pesa Global Pay Visa Virtual Card

Safaricom and Visa launch M-Pesa Global Pay Visa Virtual Card Safaricom has entered an agreement with Visa to form M-Pesa GlobalPay Visa Virtual card which will see the mobile phone-based money transfer service transact in 200 countries. This will allow customers to transact up to Sh150,000 ($1,28370) per payment and Sh300,000 ($2,567.3) per day. The deal is expected to shore Safaricom’s earnings from the mobile money services at a time M-Pesa revenues have been growing steadily. “By partnering with Visa to provide the M-Pesa GlobalPay Visa virtual card, we are…

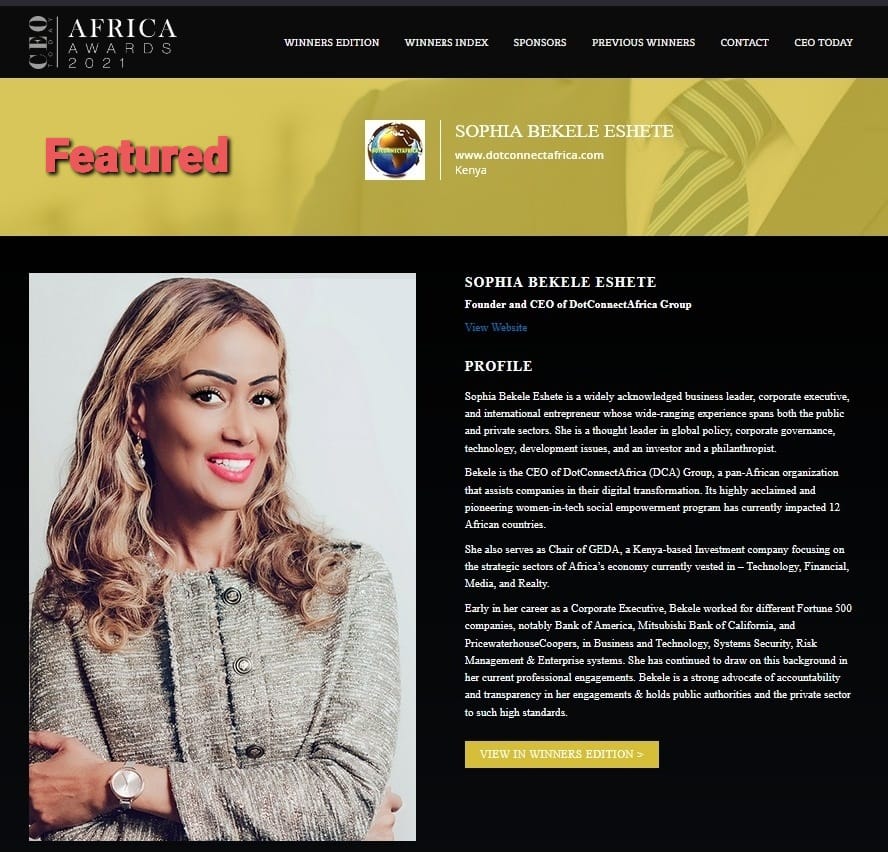

Read MoreSophia Bekele DotConnectAfrica Group CEO honored with Awards Across Multiple Continents

Sophia Bekele DotConnectAfrica Group Founder and CEO, also of US-based CBSegroup was honored with multiple awards across continents. Sophia Bekele was honored with the Silicon Valley’s Women of Influence (WOI) Award and the CEO Today Africa Awards. The Women of Influence award “recognizes established business leaders who have accomplished specific achievements in the business world in this innovation region women with a strong record of innovation in their fields, outstanding performance in their businesses, and a clear track record of meaningful community involvement. Women from every industry and profession who…

Read MoreTangerine, A Tech company boosts Financial inclusion in Africa

Leading financial services and technology platform, Tangerine officially launched on Wednesday 7th July 2021. In September 2019, Tangerine was established following the acquisition of a 100% equity stake in Metropolitan Life Insurance Nigeria by Verod Capital Management, a leading private equity firm investing in growth companies across Anglophone West Africa. Today, Tangerine is positioned to be Africa’s preferred one-stop financial solutions provider, leveraging a tech-driven, flexible, high-access platform to drive business across all the financial services segments in Africa to deepen financial inclusion, facilitate wealth creation, and protection. In…

Read MoreMaviance raises 3Million to digitize financial services

Maviance raises 3Million to digitize financial services Maviance, a Cameroon-based company providing digital financial services like agency banking and bulk bill payments, has raised $3 million in equity financing. The investment is solely from MFS Africa, the cross-border fintech company connecting mobile money providers like MTN to banks like Ecobank across over 34 countries in Africa. MFS Africa’s investment gives it an undisclosed minority stake in Maviance. Maviance’s flagship product is Smobilpay, a platform that integrates payment solutions from banks, mobile money operators, and telecom operators. Smobilpay is connected to…

Read MoreDCA WebForum Hosts Leading Ladies in Africa’s Finance Sector on timely topic of Women Bankers for Women Entrepreneurs: A post 2020 strategy for success.

The DCA Group hosted its 5th impactful and insightful Executive Roundtable conversation on the topic of “Women Bankers for Women Entrepreneurs: A post 2020 strategy for success, presenting a unique topic about “What Women Want” in Banking. The virtual meeting dialog consisted of leading ladies at the Ministry of Trade and Industry Zanzibar, Credit Bank PLC-Kenya, Bank of Ghana, NCBA Bank Group, Absa Bank and African Development Bank Group. The rich discussions encompassed Ambassadors, Ministers, Senior Managers, and Directors in top Banking and Finance Industry who are passionate and well known in…

Read MoreCBK Proposes law for mobile loan apps

CBK Proposes law for mobile loan apps Digital app lending companies operating in Kenya are set up for a shake-up after the country’s central bank proposed new laws to regulate monthly interest rates levied on loans by digital lenders in a bid to stamp out what it deems predatory practices. If approved, digital lenders will require approval from the central bank to increase lending rates or launch new products. The move comes in the wake of mounting concern about the scale of predatory lending given the proliferation of startups offering…

Read MoreDPO Group to be acquired by Network International for $288m

DPO Group to be acquired by Network International for $288m DPO Group (DPO), one of the leading, high-growth online commerce platforms in Africa operating across 19 countries, has today entered into an agreement to be acquired by Network International, a leading enabler of digital commerce across the Middle East and Africa (MEA). In a landmark deal for the African payments space, Network International will be acquiring 100% of DPO Group, which will continue to operate under the same brand. Headquartered in Dubai and listed on the London Stock Exchange, Network…

Read MoreInstagram Rolls Out New Feature For Crowdfunding

Instagram Rolls Out New Feature For Crowdfunding Instagram rolls out new personal features for crowdfunding. The coronavirus pandemic has upsurged the number of crowdfunding campaigns for hospital bills, funeral expenses, and other coronavirus-related causes, and now Instagram has announced Personal Fundraiser, a new tool that lets users raise money for personal causes. Soon people in the US, UK, and Ireland to raise money for their own personal causes. The company is launching the feature today as an initial test on Android phones, with iPhones to follow, after already making personal…

Read MoreCentral Bank of Kenya Declines to cap the free M-Pesa transactions to five

Kenya’s leading telco Safaricom has lost the bid to cap free M-Pesa transactions to five. This comes after subscribers split high-value transfers to avoid paying transfer fees, costing it billions of shillings in revenues. The company had petitioned the Central Bank of Kenya (CBK) to cap the number of multiple transactions between two numbers, according to a recent disclosure of conference call transcripts between Safaricom and investors seen by the Business Daily. Safaricom reported that customers were splitting high-value money transfers of as high as Sh60,000 to deals of below…

Read More