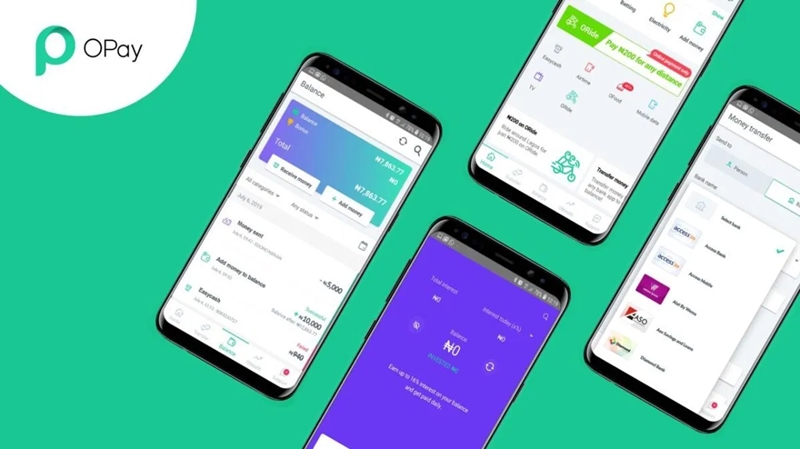

News earlier in the week broke that Opera-backed Nigerian fintech startup, OPay has reportedly shut down all its business operations in Nigeria following a letter issued by its foreign investors amidst the poor economic climate caused by the COVID-19 pandemic.. A report claims that all verticals of the startup, including ride hailing, ORide and OTrike — which were still active in other states aside Lagos; the recently launched B2B and B2C eCommerce platforms, OMall and OTrade; OExpress for logistics; and food delivery feature, OFood will be closed down. Opay launched…

Read MoreCategory: FINANCE

Digital WhatsApp Payments for SMEs launched, Pilots in Brazil

Facebook has launched its WhatsApp payments service in Brazil, enabling people to send money and make purchases from within the chat app. You use it by linking up your WhatsApp account to your Visa or Mastercard credit or debit card. This now adds Facebook as one of the digital payments and mobile money providers like Mpesa WhatsApp began testing P2P payments in India in 2018 but Brazil, where the messaging service has 120 million users, becomes the first country to get a nationwide rollout. Brazil would be the first to…

Read MoreRush to Digitization during the COVID 19 Crisis Should perpetuate financial exclusion

Rush to Digitization during the COVID 19 Crisis Should perpetuate financial exclusion.The economic effect of the current global COVID-19 lockdown will be severe. An essential focus for supporting the economic rebound is to invest in efforts to deepen economic integration and further lower trade costs. Digitization, and the creation of specialized ecosystems, will be the single most efficient approach to reduce trade cost on a global scale, which will benefit all countries currently impacted by COVID-19. A robust technical infrastructure and end-to-end digital processes (“paper-less”) are key elements to safeguard…

Read MoreUber Africa launches Uber Cash in partnership with Flutterwave

Uber will launch its Uber Cash digital wallet feature in Sub-Saharan Africa in partnership with San Francisco based Nigerian founded fintech firm Flutterwave. This will let riders to top up Uber wallets using the dozens of remittance partners active on Flutterwave’s Pan-African network. Flutterwave works as a B2B payments gateway network that allows clients to tap its APIs and customize payments applications. Uber Cash will go live this week and next for Uber’s ride-hail operations in South Africa, Kenya, Nigeria, Uganda and Ghana, Ivory Coast and Tanzania, according to Alon…

Read MoreKCB Group replaces KPMG Kenya with PwC as its external auditor

KCB Group is reported to this Thursday replace KPMG Kenya with PricewaterhouseCoopers (PwC) as its external auditor, dealing a blow to the consultancy after it lost Absa Kenya job last year. The changes now hand PwC audit control of Kenya’s top two banks — KCB and Equity Group. Last year, Equity Bank dropped Ernst & Young for PwC in 2017. KCB audit job has been among the highest payers, with remuneration paid by the lender amounting to Sh55 million in the financial year ended December 2019. Absa Kenya last year…

Read MorePayPal rolls out a new QR code feature in its app to enhance contactless payments

Cash is out and touch-free payments are during the coronavirus pandemic, this Paypal has taken cue and announced a new feature in its mobile app that will let customers make payments at stores, farmers’ markets and just about anywhere else using QR codes. You can scan a code — either from a printout or on a screen — using your phone’s camera. Payment QR codes are already fairly common, with a bunch of companies providing similar features, including Visa, Mastercard and Walmart. The biggest difference is that many existing QR…

Read MoreTelegram quits on its cryptocurrency focused subsidiary TON

After years of drama with the SEC, Telegram is calling it quits on its crypto-focused subsidiary, Telegram Open Network (TON). “Telegram’s active involvement with TON is over,” wrote Pavel Durov, founder and CEO, in an announcement on his channel. “You may see – or may have already seen – sites using my name or the Telegram brand or the ‘TON’ abbreviation to promote their projects. Don’t trust them with your money or data.” TON was a blockchain platform designed to offer decentralized cryptocurrency to anyone with a smartphone, in a…

Read MoreSix key areas for getting your business ready for COVID-19

In January 2020 the World Health Organization (WHO) declared the outbreak of a new coronavirus disease in Hubei Province, China to be a Public Health Emergency of International Concern. WHO stated there is a high risk of the 2019 coronavirus disease (COVID-19) spreading to other countries around the world.WHO and public health authorities around the world are taking action to contain the COVID-19 outbreak. However, long term success cannot be taken for granted. All sections of our society –including businesses and employers –must play a role if we are to…

Read MoreMobile banking dominance may slow down as users opt for digital lending apps

The growing dominance of mobile banking may slow down amid low employment rates and high costs of living which have pushed more Kenyans to rely on digital lending apps to make ends meet, a new report shows. The report by Egyptian investment bank, EFG Hermes, said the surge in digital lending apps has been witnessed over the years as more Kenyans sought to supplement their incomes following a spiral in the cost of living. This is likely to threaten the mobile banking revolution. While more mobile banking and digital loan…

Read MoreAfrican Startups in the credit scoring space

African startups with solutions in the credit scoring and financing space will have the chance to secure a testing phase for their technologies with French utility company ENGIE at Africa Tech Summit Kigali in February. Taking place for the third time on February 4-6, Africa Tech Summit Kigali brings together tech leaders, MNOs, banks, investors, entrepreneurs, governments, trade bodies and media to drive investment and collaboration in the African tech space. For the second year, Disrupt Africa has reprised its partnership with Africa Tech Summit Kigali to host the two-day Africa Startup Summit,…

Read More