Leading financial services and technology platform, Tangerine officially launched on Wednesday 7th July 2021.

In September 2019, Tangerine was established following the acquisition of a 100% equity stake in Metropolitan Life Insurance Nigeria by Verod Capital Management, a leading private equity firm investing in growth companies across Anglophone West Africa.

Today, Tangerine is positioned to be Africa’s preferred one-stop financial solutions provider, leveraging a tech-driven, flexible, high-access platform to drive business across all the financial services segments in Africa to deepen financial inclusion, facilitate wealth creation, and protection.

In under 2 years, the company was able to successfully acquire and rebrand several businesses, firmly establishing Tangerine. Significant strides have been made to reposition the businesses in readiness for growth by assembling a strong, agile, and experienced team that aligns with strategic thinking.

In the area of recapitalization, the Nigerian insurance industry is currently going through a suspended recapitalization process, which has sought to increase the minimum statutory capital levels for life insurance and general insurance businesses from N2 billion to N8 billion and N3 billion to N10 billion, respectively.

Innovation in the financial sector is moving at an unbelievable speed. Every minute, there’s a new idea to build, and every dawn, there’s a new financial solution that opens up the world to greater possibilities.

Despite this innovative boom, there is an urgent call to drive socio-economic transformation by designing financial solutions that are equally accessible to everyone and anyone.

Speaking on the plans to deepen financial inclusion and impact the Nigerian socio-economic landscape. The company believes in democratizing access to financial services and products and seeks to achieve this by developing simple value-adding products that are easy to understand and, which leverage technology to increase ease of accessibility, helping millions of uninsured Nigerians have protection or save for the future.

Head Life Insurance, Tangerine Nigeria Livingstone Magorimbo shared plans to establish Tangerine as the No. 1 financial solutions provider of choice in Africa by driving efficiency, value addition, and growth.

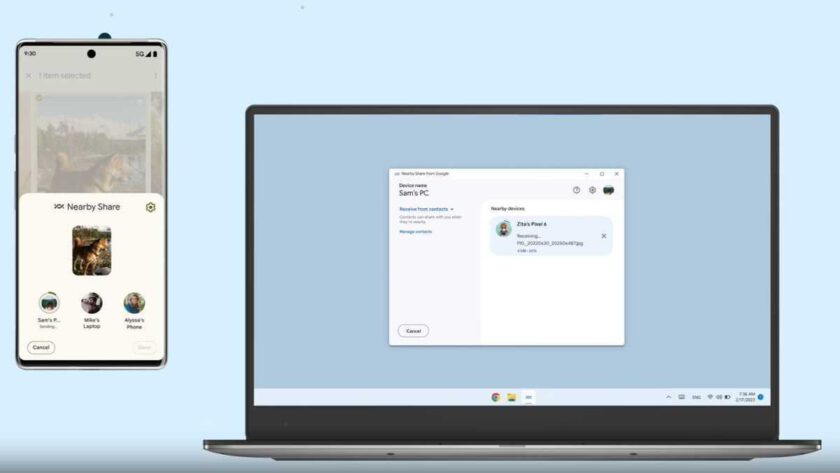

Technology is the backbone of the Tangerine financial services ecosystem. Speaking on Tangerine’s approach to product development, Head Commercial, Tangerine Nigeria Ibitunde Balogun said, “We have merged deep consumer insights and cutting-edge technology to build a range of carefully tailored and relevant products that create value by broadening the financial potential of every individual, offering a unique blend of life insurance coverage, pensions and wealth management to help individuals live without the worries of the future”.

Tangerine is equipped with a robust, integrated, and scalable digital platform that has been designed to meet the needs of a growing financial solutions ecosystem. Furthermore, it is driven by a high-performance and experienced management team. As a result, Tangerine is uniquely positioned for significant growth and impact.

As a company with the vision to power financial accessibility across Africa, Tangerine is constantly designing solutions that deliver new ways for users to experience finance whether they want to pay their bills easier, access loans faster or insure their belongings for cheaper. On one platform, users can easily access a wide range of intuitively designed financial tools that make their daily money moves seamless and long-term financial goals more attainable.

Here’s what you’ll find on Tangerine Africa: Users can bank for free, get access to instant insurance at affordable rates with an option to pay monthly for their plans. The company has also designed pensions in a way that’s fit for the 21st century, offering users a real-time view of pensions account, allowing them to make contributions instantly, and delivering them with greater returns on their pensions to enable them to retire in comfort.