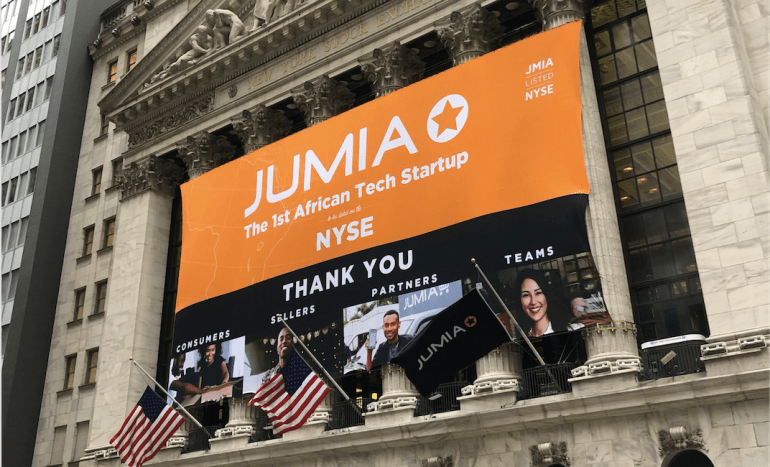

Jumia billed as Africa’s first “tech unicorn”, is a venture-capital funded company valued at more than $1bn on the New York Stock Exchange. Its lack of a profitable model didn’t seem to matter much on the first day of trading on Friday, as the stock surged by 75%.

Jumia filed S1 documents with the US Securities and Exchange Commission (SEC) last month to launch its IPO, which was underwritten by banks such as Morgan Stanley and Citigroup.

The stock went on sale on Friday 12 April 2019, initially valued at US$14.50 per share, but traded at US$25.46 to value the company at more than US$1.9-billion. In spite of its IPO success, however, Jumia is still not profitable. Its most recent financial results, released last April, saw its adjusted losses more than double to EUR39.4 million.

The company was founded by two Frenchmen in Lagos in 2012, and Nigeria is its largest market. Jumia operates online marketplaces in 14 countries including Kenya, Morocco and Egypt. The largest owner is South Africa’s MTN, with other pre-IPO investors including AXA, Millicom, Pernod Ricard, Rocket Internet and MasterCard.

A sense of euphoria was clear as the stock soared in New York. Steven Grin, managing partner of Lateral Capital in New York, a Jumia shareholder, called the listing “a watershed moment” for entrepreneurship in Africa. Jumia, he argues, stands comparison with Alibaba in 2005 when Yahoo! bought a 40% stake.

Other investors, however, were more cautious. “We have watched MTN being burnt over and over again in Nigeria”, said Byron Lotter, portfolio manager at Vestact Asset Management in Johannesburg. Investing in Jumia “does come with heavy political risks”. MTN has said that a planned IPO of its Nigerian unit is on hold until a $2bn tax dispute with the Nigerian authorities is resolved.

Is it really African?

Cameroon-based Rebecca Enonchong, founder and CEO of AppsTech, sees the IPO as a “desperate exit for existing investors who are obviously running out of cash. Obviously they couldn’t find new institutional investors.”

- Jumia’s 2017 losses of €165m ($187m) increased to €170m in 2018.

- The company said in its IPO documents that continued losses mean it cannot guarantee that it will achieve or sustain profitability or pay any cash dividends in the foreseeable future.

Co-founder Jeremy Hodara told Jeune Afrique in late 2018 that losses “have bottomed out”.

Enonchong says African e-commerce is a very difficult and expensive market to get into. While Western e-commerce rests on the assumption that the post office will deliver to all points, that is often not the case in Africa. “You have to build your own distribution network.”

Other e-commerce operations have crashed and burned, including:

- Jumia’s Nigerian rival Konga, which was taken over by Zinox Technologies in 2018 after firing 60% of its staff in 2017;

- CFAO, the francophone Africa distributor, which suspended its online “Africashop”;

- Naspers, which has twice withdrawn from the Kenyan market.

Enonchong questions Jumia’s African credentials, pointing out that the company is registered in Germany, has its headquarters in Dubai and its technical development in Portugal. “There’s little that’s African.” Still, she says, the company has employed Africans on the continent in senior positions and allowed them to gain experience and exposure. The IPO, she says, also has the merit of getting people to talk about African tech.

Jumia, Enonchong argues, could and should have used some of the money invested in it to finance start-up companies capable of filling some of the gaps in African supply chains. But the company “never believed in local start-ups. They have not understood the market. They have not committed to the ecosystem, and act as if they were in a European ecosystem. African tech should not be judged on Jumia.”

If the performance of the company’s shares keep improving over time, the largest shareholder of Jumia — MTN Group — may eventually sell its stock in the company which could result in raising more than the anticipated figures.

Earlier in the year, MTN had expected to raise about $600 million from the sales of its shares in Jumia through the IPO. As it is, the efforts of both MTN and Rocket Internet to cash out on Jumia are gradually paying off.