Facebook has launched its WhatsApp payments service in Brazil, enabling people to send money and make purchases from within the chat app. You use it by linking up your WhatsApp account to your Visa or Mastercard credit or debit card. This now adds Facebook as one of the digital payments and mobile money providers like Mpesa WhatsApp began testing P2P payments in India in 2018 but Brazil, where the messaging service has 120 million users, becomes the first country to get a nationwide rollout. Brazil would be the first to…

Read MoreTag: mobile money

Rush to Digitization during the COVID 19 Crisis Should perpetuate financial exclusion

Rush to Digitization during the COVID 19 Crisis Should perpetuate financial exclusion.The economic effect of the current global COVID-19 lockdown will be severe. An essential focus for supporting the economic rebound is to invest in efforts to deepen economic integration and further lower trade costs. Digitization, and the creation of specialized ecosystems, will be the single most efficient approach to reduce trade cost on a global scale, which will benefit all countries currently impacted by COVID-19. A robust technical infrastructure and end-to-end digital processes (“paper-less”) are key elements to safeguard…

Read MoreMTN Rwanda announced phasing out physical airtime

MTN Rwanda has announced that it will phase out the sale and distribution of physical airtime vouchers as of February 15th, 2020. Airtime will only be purchased and loaded through MTN’s digital Electronic Recharge Service (ERS) or MTN Mobile Money (MoMo). This is in their quest to continue to lead the digital agenda for a brighter Rwanda and more importantly contribute to the country’s green growth. Speaking about this decision to go wholly digital, MTN’s Chief Sales and Distribution Officer, Mr Norman Munyampundu said, “MTN Rwanda is set to deliver…

Read MoreKorba launched an all inclusive shortcode

Korba, a leading Ghanaian Fintech brand owned and operated by Halges Financial Technologies Ltd, has launched an all inclusive and innovative shortcode that allows users to transfer funds, pay bills, purchase airtime, data bundles among others. The newly introduced *365# promises to be a game-changer in Ghana’s financial services ecosystem providing users with utmost convenience and security. Speaking at the launch, Nelson Da Seglah, CEO of Halges Financial Technologies said the introduction of the shortcode is in line with the company’s commitment to continuously evolve to serve customers better. He…

Read MoreCellulant’s super payments app Tingg unveiled in 8 African countries

Cellulant the African fintech company has Tuesday announced the launch of Tingg, an all-in-one, multi-functional consumer super app that will include a wide array of payment, commerce and financial services into a single platform that will revolutionize the way customers interact with digital payment services in the continent. The pan-African payments firm has been quietly building a payments super app to bring bill payments, remittances, lending, group investments, food and gas orders in one app in its eight markets across Africa. The firm has now announced a major rebrand of…

Read MoreUnregulated digital apps loans, consumer protection among emerging issues that require attention- CBK Kenya Study

The 2019 FinAccess Household Survey report presents results of data collected during October – December 2018 covering 11,000 households across the country. The survey targeted individuals aged 16 years and above, from scientifically selected households, designed to provide significant estimates at the national and regional level and by residence (rural and urban areas). The 2019 survey focussed more on the usage, quality and impact/welfare dimensions of measuring financial inclusion. In addition, the questionnaire incorporated a needs-based framework to the measure the relevance of financial services and products; financial health and…

Read MorePesapal starts Payment processing for low cost Kenyan Airlines

Pesapal has this year started processing payments for low cost carriers in Kenya. Jetways Airlines, Silverstone Air and Skyward Express will from now on use Pesapal’s integrated payment system to process Mpesa, Visa, mVisa, MasterCard and American Express payments on their respective websites. This not only gives travellers the freedom to pay conveniently for their flights but also makes it easier for airlines to track payments and traveller flight information. These airlines join African Express Airways in Kenya and Eagle Air in Uganda showing Pesapal’s growth as a payment processor…

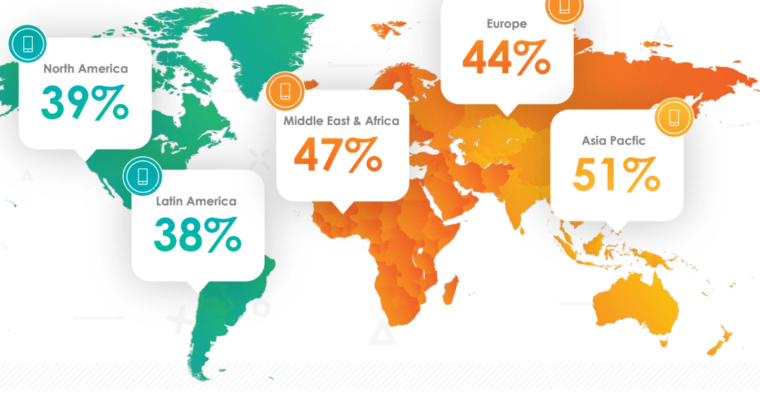

Read MoreMobile now accounts for 47% of all online transactions in Middle East and Africa, Criteo

The advertising platform Criteo released its 2018 Q2 Global Commerce Review, having analysed browsing and purchasing data from over 5,000 retailers in more than 80 countries. Michele Iozzo, managing director for the Middle East & Africa, Criteo, says, “Mobile continues to command a higher share of the online transactions pie driven by high smartphone penetration across the MEA region. The study has revealed a year-on-year increase of the share of In-App Transactions for retailers who promote their shopping app, proving that it isn’t enough to just launch an app, but…

Read MoreFive African tech trends to watch in 2018

The BBC’s Clare Spencer picks five African tech trends to look out for in 2018. Land registry you can’t tamper with The idea: Documentation is often lacking in parts of Africa, leading to land disputes because it isn’t clear who owns the land. Even when there are records, sometimes they have been tampered with. A record that cannot be deleted, using something called blockchain, could be used to prevent these disputes. Blockchain is a method of recording data – a digital ledger of transactions, agreements, contracts – anything that needs…

Read MoreSafaricom simplifies M-PESA access to businesses

Kenya is an undisputed global leader when it comes to mobile money services. In 2007, the telecom operator Safaricom launched its mobile money service M-Pesa as a simple way to text small payments between users. A decade later, M-Pesa has become the world’s most successful money transfer service. Safaricom, a major Mobile service provider in Kenya has announced a release of a feature-rich M-PESA Application Programming Interfaces (APIs) portal to businesses in the country. Dubbed Daraja, the portal will enable businesses to easily integrate with the platform drastically cutting down…

Read More