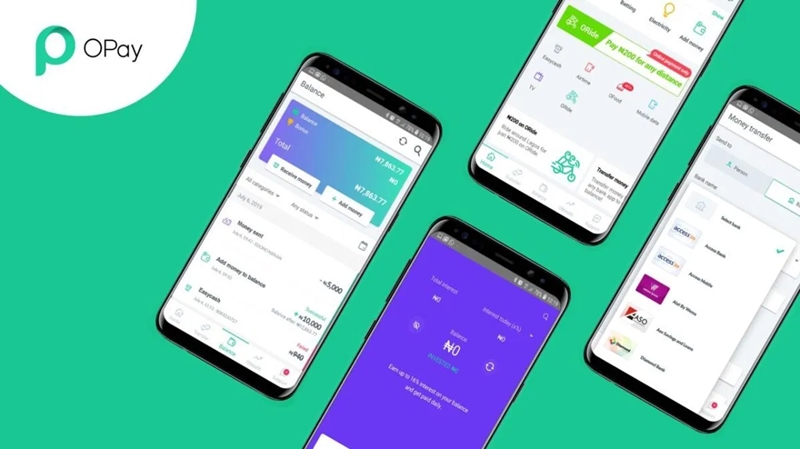

News earlier in the week broke that Opera-backed Nigerian fintech startup, OPay has reportedly shut down all its business operations in Nigeria following a letter issued by its foreign investors amidst the poor economic climate caused by the COVID-19 pandemic.. A report claims that all verticals of the startup, including ride hailing, ORide and OTrike — which were still active in other states aside Lagos; the recently launched B2B and B2C eCommerce platforms, OMall and OTrade; OExpress for logistics; and food delivery feature, OFood will be closed down. Opay launched…

Search Results for: payments

Digital WhatsApp Payments for SMEs launched, Pilots in Brazil

Facebook has launched its WhatsApp payments service in Brazil, enabling people to send money and make purchases from within the chat app. You use it by linking up your WhatsApp account to your Visa or Mastercard credit or debit card. This now adds Facebook as one of the digital payments and mobile money providers like Mpesa WhatsApp began testing P2P payments in India in 2018 but Brazil, where the messaging service has 120 million users, becomes the first country to get a nationwide rollout. Brazil would be the first to…

PayPal rolls out a new QR code feature in its app to enhance contactless payments

Cash is out and touch-free payments are during the coronavirus pandemic, this Paypal has taken cue and announced a new feature in its mobile app that will let customers make payments at stores, farmers’ markets and just about anywhere else using QR codes. You can scan a code — either from a printout or on a screen — using your phone’s camera. Payment QR codes are already fairly common, with a bunch of companies providing similar features, including Visa, Mastercard and Walmart. The biggest difference is that many existing QR…

Cellulant’s super payments app Tingg unveiled in 8 African countries

Cellulant the African fintech company has Tuesday announced the launch of Tingg, an all-in-one, multi-functional consumer super app that will include a wide array of payment, commerce and financial services into a single platform that will revolutionize the way customers interact with digital payment services in the continent. The pan-African payments firm has been quietly building a payments super app to bring bill payments, remittances, lending, group investments, food and gas orders in one app in its eight markets across Africa. The firm has now announced a major rebrand of…

Global payments firm Adyen partners with Cellulant to onboard M-PESA on Netflix, eBay, Airbnb, Facebook

Cellulant has announced a partnership with Adyen – a global payment company, further increasing Adyen’s capability to offer its global merchants access to key local payment methods in major African markets. The deal will see Ayden, which replaced PayPal on eBay, bring mobile money platforms such as M-PESA, Airtel Money, Equitel, Tigo Pesa and MTN Mobile Money, as well as several online and mobile banking payment methods to eBay, Facebook, Airbnb, Spotify, Uber and Netflix. Adyen will have access to 40 mobile money operators, over 600 local & international merchants and over 120 banks in…

PesaPal adds new payments options on app in partnership with M-Pesa, Visa & MasterCard

Electronic payments firm PesaPal has added payment options in its integrated mobile money processing platform for shoppers and those making utility payments. The company said its users will be able to leverage on its new app — dubbed PesaPal Mobile — to buy airtime, pay bills, book flights and holidays, purchase event tickets and pay school fees. It has partnered with Safaricom’s M-Pesa, Visa and MasterCard to enable the payments “Available on both Android’s Google Play Store and Apple‘s App Store, the app is geared towards consumers looking to simplify…

BitPesa, Kenyan Bitcoin Payments Startup, Acquires European Money Transfer Platform

BitPesa, Kenyan bitcoin payments startup, has acquired TransferZero, Spain-based online money transfer platform, in a bid to further accelerate its growth across the world. BitPesa, which raised two funding rounds last year to take its total secured investment to around the US$10 million mark, launched in Kenya in 2013 and also operates in Nigeria, Tanzania, Uganda, the DRC, the UK and Senegal. TransferZero was founded in 2016 and was the first fintech company licensed by the Bank of Spain as an authorized payment institution. The company is a partner of…

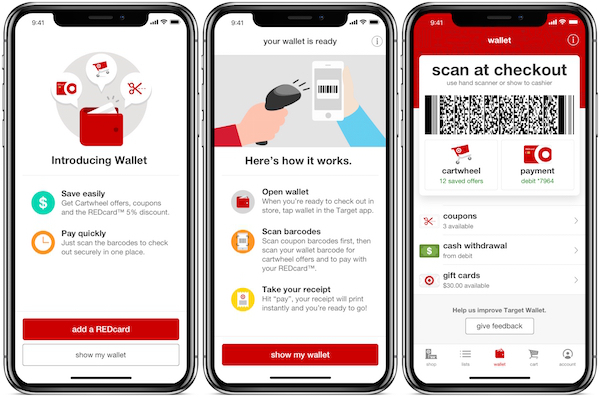

Target Launches its own Mobile Payments System with Debut of Wallet

As promised earlier, Target launched its own mobile payments system with the introduction of “Wallet” in the Target app. Wallet, as the name implies, allows Target shoppers in-store to both check out using their smartphone as well as take advantage of their Cartwheel digital coupons and discounts with only one scan of their barcode. Already, Cartwheel savings in Target’s app had worked like this – that is, after adding the discounts on selected products to your Target account using the Cartwheel feature, shoppers could present a barcode to be scanned…

Technology in Business

Technology has changed the way businesses operate and interact with customers. The fast-paced development of technology has impacted various aspects of business, from operations and marketing to customer service. Businesses are now relying more and more on technology to enhance their competitiveness, increase efficiency, and reach out to new customers. In the past, businesses relied on traditional methods such as print advertisements, billboards, and door-to-door sales. Today, businesses can reach a vast audience through the Internet and social media. Companies can target specific demographics, launch innovative marketing campaigns, and reach…

Safaricom and Visa launch M-Pesa Global Pay Visa Virtual Card

Safaricom and Visa launch M-Pesa Global Pay Visa Virtual Card Safaricom has entered an agreement with Visa to form M-Pesa GlobalPay Visa Virtual card which will see the mobile phone-based money transfer service transact in 200 countries. This will allow customers to transact up to Sh150,000 ($1,28370) per payment and Sh300,000 ($2,567.3) per day. The deal is expected to shore Safaricom’s earnings from the mobile money services at a time M-Pesa revenues have been growing steadily. “By partnering with Visa to provide the M-Pesa GlobalPay Visa virtual card, we are…