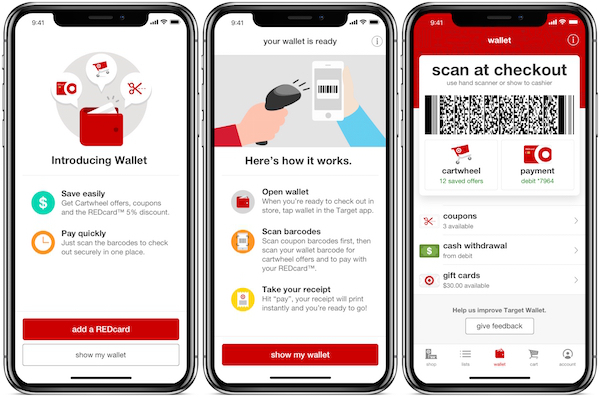

As promised earlier, Target launched its own mobile payments system with the introduction of “Wallet” in the Target app. Wallet, as the name implies, allows Target shoppers in-store to both check out using their smartphone as well as take advantage of their Cartwheel digital coupons and discounts with only one scan of their barcode.

Already, Cartwheel savings in Target’s app had worked like this – that is, after adding the discounts on selected products to your Target account using the Cartwheel feature, shoppers could present a barcode to be scanned at the point-of-sale to take advantage of the savings. The only difference between that and today, is that shoppers can now also choose to pay using their Target REDcard at the same time.

Target’s REDcard is available as both a debit card that links to customers’ bank accounts and a store credit card, and offers 5 percent back on purchases to encourage its use.

In the near future, Target Wallet will also support the ability to add and pay with Target GiftCards as well, the retailer says.

Target isn’t the only major brick-and-mortar retailer with its own payments system. Walmart previously launched Walmart Pay; CVS has CVS Pay; and Kohl’s has Kohl’s Pay, for example. (Perhaps we should give Target credit for not naming its solution Target Pay.)

In addition to saving the company money by shifting consumers to store cards, in-house mobile payment solutions give retailers access to the consumer data they would have otherwise given up, had the shopper checked out with a mobile payment solution like Apple Pay, where that data is not shared.

“Wallet in the Target app makes checkout easier and faster than ever,” said Mike McNamara, Target’s chief information and digital officer, in a statement about Wallet’s launch. “Guests are going to love the convenience of having payment, Cartwheel offers, Weekly Ad coupons and GiftCards all in one place with Wallet.”

The new Wallet feature is available on both Android and iOS versions of the Target app.