Jumia, the ‘African’ ecommerce company that has its corporate headquarters in Dubai and operations in 14 African countries including Egypt, Morocco, Tunisia, and Algeria, continues to struggle after an initial good run at the New York Stock Exchange. It’s stock closed at $6.68, an all-time low, on Friday, with the market cap going down to ~$520 million. For the sake of context, the Rocket Internet-founded Jumia had become a unicorn (with a valuation of $1.08 billion) in 2016 (when it was known as Africa Internet Group or AIG) after raising…

Read MoreTag: IPO

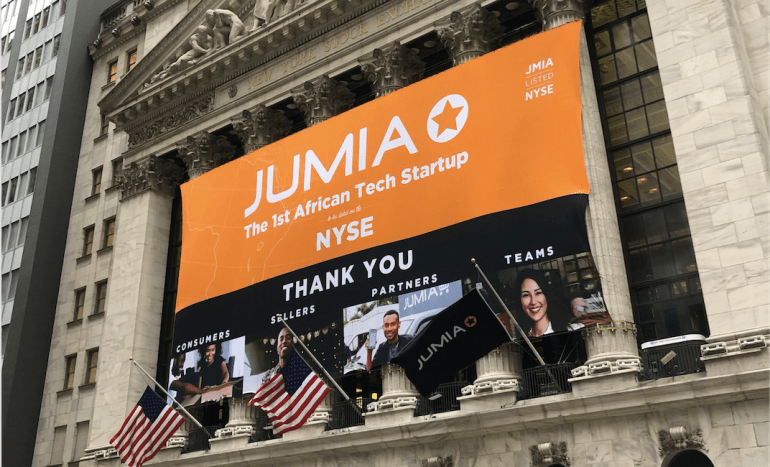

Jumia hits US$196-million in landmark New York IPO but investors may regret funding an elusive dream

Jumia billed as Africa’s first “tech unicorn”, is a venture-capital funded company valued at more than $1bn on the New York Stock Exchange. Its lack of a profitable model didn’t seem to matter much on the first day of trading on Friday, as the stock surged by 75%. Jumia filed S1 documents with the US Securities and Exchange Commission (SEC) last month to launch its IPO, which was underwritten by banks such as Morgan Stanley and Citigroup. The stock went on sale on Friday 12 April 2019, initially valued at…

Read MoreAfrica’s e-commerce giant Jumia to list on the New York Stock Exchange

Reports of an initial public offering (IPO) by Jumia, the pan-African conglomerate of e-commerce businesses, have been finally confirmed but details of its financials do not paint a pretty picture. Jumia has filed to launch its IPO on the New York Stock Exchange, documents from the U.S. Securities and Exchange Commission (SEC) show. The intended IPO is a landmark first for e-commerce and tech businesses on the continent. It could also mark a possible exit by Rocket Internet, Jumia’s German parent company, divesting its remaining 28% stake in the company.…

Read MoreAlibaba IPO Pours Shares Into Shrinking Pool of Stock

Alibaba Group’s (BABA) initial public offering was a success by any measure. At $25 billion, it was the largest in history. Investors were so eager to add the Chinese e-commerce giant to their portfolios that the shares soared 38 percent on their debut, the biggest first-day jump for an IPO of at least $10 billion, according to data compiled by Bloomberg. When trading ended on Sept. 19, the company had a market value of $231 billion, more than Amazon.com’s (AMZN) and EBay’s (EBAY) combined. Some investors warned that the clamor for Alibaba shares could trigger a…

Read More