The world is becoming a consumers’ market where future trends are now determined by an impatient customer with a smart phone. The modern shopper wants the best for less right now. They also demand that brands speak to and about their unique individuality.

These conversations are taking place online in real time, feeding research, design and development teams with enough data to make accurate predictions of what will sell in the future. How this information is collected and collated is being made possible by technology.

What does Artificial Intelligence mean for a continent with very little and in some cases no data at all?

Most of Africa, and specifically Sub Saharan Africa has a huge information gap. Data is scattered all over the place and it would be difficult to collect and analyse what products the consumer actually interacts with.

While the issue of Africa was not specifically addressed at this forum, I believe it is both a challenge and awesome opportunity. The truth is it might be very expensive to implement Artificial Intelligence when priorities are in areas of more need. We certainly lack the framework on which to roll it out but we can leapfrog as we avoid the mistakes the developed markets are encountering.

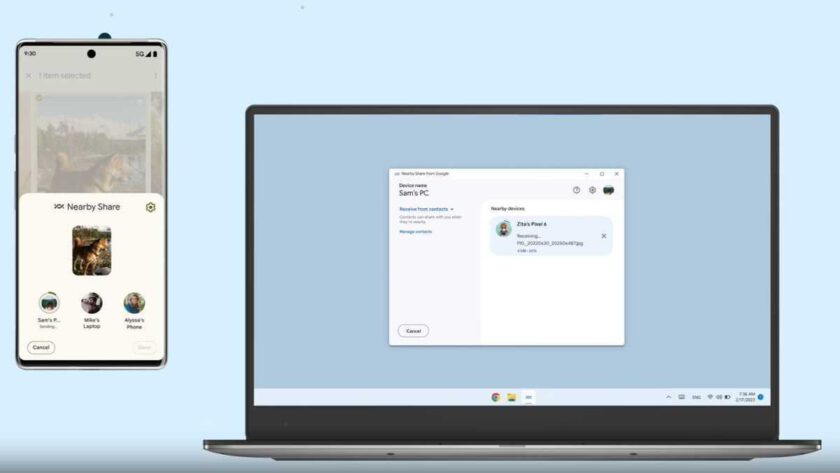

The largest single opportunity lies in that fact that we have the largest population of smartphones totalling over 350million and this is set to double before 2030. In East Africa mobile-money is a major channel of business and personal transaction that presents an opportunity for brands to connect and convert users into consumers, bypassing normal channels of advertising, retailers and middlemen.

The 4th revolution is an era of data and analytics and Africa’s tech hubs in Nigeria, South Africa and Kenya are leading from the front in creating globally relevant local solutions for a populace that is proud of their continent.

Our conversations confirmed that digital transformation presents a great opportunity to bridge the gap between emerging and developed markets by embracing technologies through programmes such as those supported by Microsoft. Kenya has the highest penetration of retail channels far out gunning Nigeria. The number of shopping malls has grown from a under a dozen just over 10 years ago to over 55 in 2018. This must have been encouraged by a growing middle income group looking to improve their lifestyle.

The biggest gap now is how to give them access to the right products, from the right sources, affordably. Most retail outlets in Kenya target and serve consumers looking to enjoy fast food, affordable apparel and recreational facilities as opposed to luxurious premium goods and services. With the absence of a high street in most Africa cities, multi-use malls are all that is available for middle-income earners who simply cannot afford over-priced luxury goods that might end up being cheap knock offs. Most would rather source them online from a trusted source for less.

Mwai is a director at Strategic Innovative Design Solutions Limited and runs Luxuria Lifestyle International’s franchise in the region.