Ethiopia’s parliament recently passed a bill to open up the country’s financial sector to an estimated five million citizens living abroad or with dual nationality, including allowing them to buy shares in local banks and start lending businesses. Reports Reuters The changes are part of a raft of economic reforms initiated by Prime Minister Abiy Ahmed when he came to power last year, partly aimed at boosting the country’s foreign exchange reserves, which had dropped precariously low. “The law will enable the Ethiopian born diaspora to take part in the…

Read MoreCategory: BUSINESS

Andela to lay off 400 staff across Africa, confirms $50M in revenue

Africa-focused tech talent accelerator Andela will cut 400 junior engineers across Kenya, Uganda and Nigeria, Chief executive and co-founder Jeremy Johnson said the move will impact junior engineers as the company focuses on boosting its senior talent. “This shift in demand also means that we now have more junior talent than we are able to place,” he said in a statement. “This is a challenge for the business, and for these junior engineers who want and deserve authentic work experiences that we are not able to provide.” Approximately 250 junior…

Read MoreCybercrime Report Tracks Growing Threat of Networked Cybercrime

LexisNexis® Risk Solutions today released at the Digital Identity Summit its Cybercrime Report providing a comprehensive view into the shifting global fraud landscape from January 2019 through June 2019. During this period, the LexisNexis® Digital Identity Network® recorded 16.4 billion transactions, of which 277 million were human-initiated attacks, a 13% increase over the second half of 2018. The report highlights a shift toward networked, cross-organizational and cross-industry fraud, and gives insight into the evolution of bot attacks targeting new accounts in media and e-commerce. Key Findings from the LexisNexis Risk…

Read MoreTala Microloan Startup gains $110 Million In latest Funding

Tala, a Los Angeles startup that makes microloans to consumers and small business owners in emerging markets, is announcing today that it has raised $110 million in funding. The new Silicon Valley venture capital firm RPS Ventures, cofounded by Kabir Misra, former managing partner at Softbank’s $100 billion Vision Fund, is leading the round. Tala’s backers include PayPal, billionaire Steve Case’s VC firm Revolution, Chris Sacca’s Lowercase Capital and Data Collective, among others. The new funding values Tala at nearly $800 million, according to an investor. Tala has raised more…

Read MoreApple Card just quietly launched, takes a new approach to credit cards use

Last week, Apple Card was launched, a new product that just might make the tech firm a lot of money. However there wasn’t much elation and ululation. This is because, anyone who put their name down to get Apple notifications likely got a highly personalized invitation about the product. To celebrate the launch, Apple didn’t release an expensive ad featuring exited customers, rather, Apple’s YouTube page was filled with explanatory videos. The Card is Apple’s different approach to credit cards use, statements are handled, and rewards are redeemed, without any…

Read MoreNigeria proposes law to tax local online purchases

Online purchases in Nigeria could soon come with a tax bill in part of plans to raise more revenue to fund a record budget, Nigeria’s government is considering a 5% Value Added Tax (VAT) specifically for online purchases. Babatunde Fowler, head of Nigeria’s federal tax agency, says the government may appoint banks as agents to deduct 5% VAT on all local online purchases with a bank card. The policy could be in place by early next year, Fowler said in an interview with Premium Times, a local online newspaper. This…

Read MoreKenya based Direct Pay Online (DPO) acquires SA’s PayFast, a payment firm

Nairobi-based online payment service provider Direct Pay Online (DPO) has acquired PayFast, a payment processor based in South Africa. A statement said the transaction by the DPO Group was executed through a mix of shares and cash, with the PayFast management team remaining key shareholders in the Group. Following the transaction, DPO Group said it will be providing services to over 100,000 merchants across 18 African markets. “The integration of PayFast into DPO’s services will increase the range of payment options available to DPO’s business customers, whilst providing a Pan-African…

Read MoreNot coming to Ethiopia to Invest unless central bank rectifies the wrongful appropriation of diaspora shares – Sophia Bekele Eshete

The monies and profits confiscated from the sale of the diaspora shares should be returned in full Op-Ed By Sophia Bekele Eshete, Addis Fortune | July 20, 2019 The National Bank of Ethiopia (NBE) passed a guideline about relinquishing shares in banks owned by foreign nationals of Ethiopian origin in 2016. The majority of the public, particularly the intellectuals and legal experts who understood what happened with the sale of the shares by the central bank and the financial institutions, know that it was a huge mistake. Various voices have…

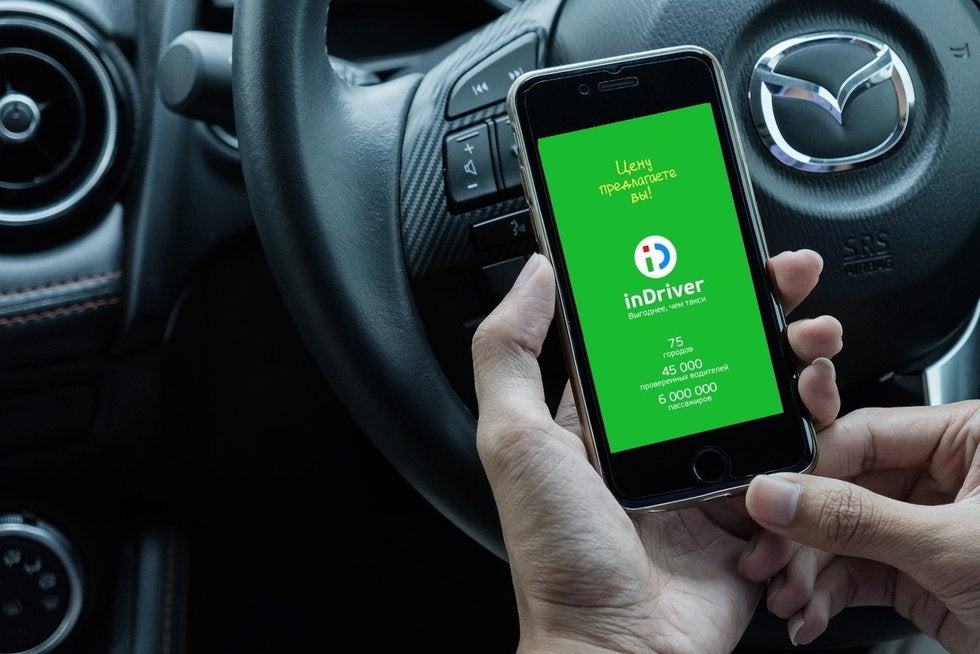

Read MoreNegotiated fares taxi hailing app inDriver, targets more African cities

Online ride hailing service, inDriver, which allows passengers to negotiate the fare with drivers, has begun recruiting drivers in Harare for the service, which it intends to launch in the capital towards the end of this month. inDriver, which is headquartered in New York, has 26 million users in more than 200 cities throughout the world. The service is already operating in South Africa, Kenya, Tanzania and Uganda. The inDriver app is used by passengers and drivers to be linked up and negotiate fares. The app can also be used…

Read MoreBy 2025, there will be commercial 5G services in at least seven African markets

Digital technologies are having a profound impact on the way people live, work, play and communicate. This is especially true in Sub-Saharan Africa where such technologies increasingly provide access to life-enhancing services for individuals and communities that would otherwise be excluded, due to infrastructure, skills and funding shortages. Key trends in the region’s digital landscape, including a youthful demographic and the increasing digital disruption of industries, point to growing demand for next-generation connectivity. It is universally accepted that high-speed, reliable and robust network infrastructure is critical to the growth of…

Read More