Kenya’s Twiga Foods has raised a total of $30 million from lenders and investors led by Goldman Sachs. Top American investment bank Goldman Sachs is the latest to acquire a stake in Kenyan start-up Twiga Foods following a Sh2.44 billion ( $23.75 million) deal that will help the agro-based firm spread across the country and Africa. The B2B food distribution company financed $6.25 million of the funding in convertible debt and $23.75 million in equity, classified as a Series B round. IFC, TLcom Capital, and Creadev joined Goldman on the…

Read MoreMonth: October 2019

Global social media Ad spend to surpass print for the 1st time – Zenith Study

Social media will overtake print ad spend for the first time this year, becoming the third largest channel for advertising, according to the latest forecasts from Zenith. By offering sophisticated targeting capabilities and unparalleled reach for businesses of all sizes, social and search platforms have chipped away at traditional advertising sources. It’s predicted that growth will slow to 17 per cent in 2020 and then 13 per cent in 2021, at which point it will account for 16 per cent of the market. “Social media advertising gives brands the opportunity…

Read MorePayPal to enter China Market after a 70% stake acquisition in GoPay

PayPal will become one of the first international companies to gain a payments license in China, after news emerged that the state-owned People’s Bank of China (PBOC) has greenlighted PayPal’s acquisition of a majority stake in local company GoPay. PayPal, through one of its local China-based subsidiaries called Yinbaobao, will acquire a 70% stake in GoPay, according to a statement on GoPay’s website [in Chinese]. The deal is expected to close in Q4 2019. The company’s full statement on the acquisition is below: The People’s Bank of China has approved…

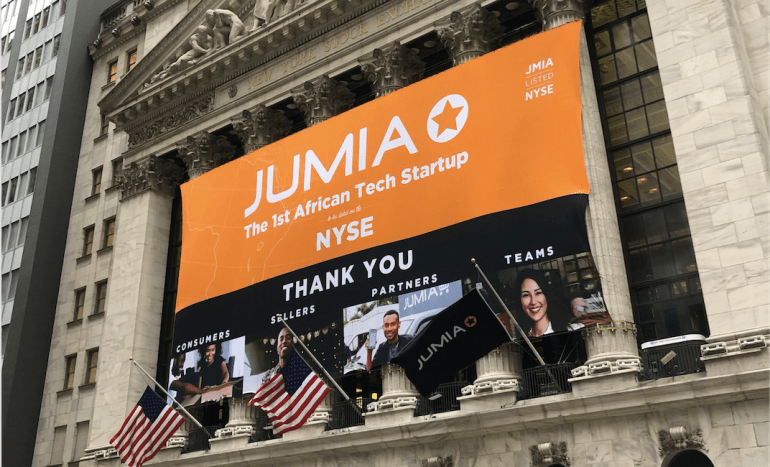

Read MoreJumia’s stock has reportedly lost more than half of its value since its NYSE public IPO

Jumia, the ‘African’ ecommerce company that has its corporate headquarters in Dubai and operations in 14 African countries including Egypt, Morocco, Tunisia, and Algeria, continues to struggle after an initial good run at the New York Stock Exchange. It’s stock closed at $6.68, an all-time low, on Friday, with the market cap going down to ~$520 million. For the sake of context, the Rocket Internet-founded Jumia had become a unicorn (with a valuation of $1.08 billion) in 2016 (when it was known as Africa Internet Group or AIG) after raising…

Read MoreSingapore based Credit scoring fintech company, CredoLab, launches in Kenya

Alternative credit scoring fintech company, CredoLab, launched in Kenya recently is lined to drive financial inclusion by credit scoring more people, especially those who are new to bank and credit. CredoLab announced that it is in negotiations with the large financial institutions, digital banks, credit bureaus, consumer lenders and retail operations in Kenya. Michel Massain, Sales for Europe and Africa at CredoLab says, “With the trend in Kenya of banks shifting from traditional banking halls to digital platforms, our alternative credit scoring technology is perfectly timed to help lenders provide…

Read MoreCellulant’s super payments app Tingg unveiled in 8 African countries

Cellulant the African fintech company has Tuesday announced the launch of Tingg, an all-in-one, multi-functional consumer super app that will include a wide array of payment, commerce and financial services into a single platform that will revolutionize the way customers interact with digital payment services in the continent. The pan-African payments firm has been quietly building a payments super app to bring bill payments, remittances, lending, group investments, food and gas orders in one app in its eight markets across Africa. The firm has now announced a major rebrand of…

Read More